Tesla’s (NASDAQ:TSLA) Q3 2024 earnings call comes on the heels of the company’s Q4 and FY 2024 Update Letter, which was released after the closing bell on January 29, 2025.

Tesla’s Q4 2024 results:

- Earnings Per Share (GAAP): $0.66 per share

- Earnings Per Share (Non-GAAP): $0.73 per share

- Operating Income: $7.1 billion GAAP; $7.1 billion GAAP net income in 2024; $2.3 billion in Q4 including $0.6 billion mark-to-market gain on digital assets.

- Total Revenues: $25.7 billion

- Total Automotive Revenues: $19.80 billion

Q4 & FY 2024 Earnings Call at 4:30pm CT today https://t.co/uFCg69a6tN— Tesla (@Tesla) January 29, 2025

The following are live updates from Tesla’s Q4 and FY 2024 earnings call. I will be updating this article in real-time, so please keep refreshing the page to view the latest updates on this story. The first entry starts at the bottom of the page.

17:41 CT – And that closes Tesla’s Q4 and FY 2024 earnings call! Thanks so much for joining us, and see you next quarter!

17:40 CT – Dan Levy of Barclays asks about Trump’s anti-EV mandate and Elon Musk’s view on it. The CEO noted that at this point, sustainable transport is inevitable. “At this point I think sustainable transport is inevitable. You can’t stop the advent of electric cars. It’s gonna happen. The only thing holding back electric cars is range, and that is a solved problem,” Musk said.

17:37 CT – Pierre Ferragu of New Street Research asked about Tesla’s plans to deploy robotaxis on June. He wonders if he can drive down to Texas in June to test it. Musk said sure, and at the time, Tesla would be using its own fleet for its initial autonomous ride-hailing program. Cars won’t be from individual owners.

Musk also predicts that Tesla owners will be able to add car their cars to the robotaxi fleet by next year.

Tesla is also working toward FSD Unsupervised which will allow people to check their emails, texts, etc., while the vehicle is in motion, but the company is very cautious. Tesla has seen that people are turning off FSD Unsupervised to check their texts.

17:30 CT – Adam Jonas of Morgan Stanley asked if Elon Musk still does not believe in Lidar. Elon Musk says he still does not. “Obviously, humans drive without shooting lasers out of their eyes,” Musk joked. He also explained that he is not anti-Lidar per se. He’s just anti-Lidar when it comes to autonomous cars.

17:25 CT – As for FSD in China, Musk noted that training videos in China cannot be exported out. Tesla figuring out how to train FSD Unsupervised in China. One of the challenges is bus lanes, which are very complex in China.

“Hopefully, we can have Unsupervised FSD in other countries next year,” Musk said.

17:18 CT – Analyst questions start with Bernstein. He asks Elon Musk about what he is doing to push Tesla’s management team to accelerate the company’s programs. Musk noted that Tesla is working on perfecting real-world AI. “I spend a lot of time with the Tesla AI team and the Tesla Optimus team,” he said.

Musk noted that there are many challenges with Optimus and vehicle autonomy, but the pieces are there. He predicts Europe will be a challenge for FSD Unsupervised. FSD Unsupervised is expected to be presented to the EU in the Netherlands in May, with a release probably next year.

17:15 CT – A question about HW3 vehicles was asked. Tesla noted that the company is not giving up on HW3. Tesla is still working on HW3 but updates will trail HW4 releases.

“We are going to have to upgrade Hardware 3 for people who bought FSD. That’s the honest answer. It’s going to be painful and difficult but that’s what we’re going to have to do,” Musk admitted.

Another question was asked if Tesla has given up on Solar Roof. Tesla noted that it has not. Musk noted that Tesla has found growth by distributing Solar Roof to the roofing industry.

17:14 CT – Another question is asked, this time about the Tesla Semi and how it will affect revenue and scale. Tesla noted that preparations for production are ongoing, and that production is expected to start late this year from Reno. He also thinks the Semi will be incredibly valuable with FSD Unsupervised.

Musk noted that the United States actually has a shortage of truck drivers. And truck drivers are human, so they get tired. “I have a lot of respect for truck drivers, because it’s a tough job,” Musk said.

He noted that more people are leaving trucking than those entering it. With this in mind, autonomy is extremely important. “It’s a several billion-a-year opportunity,” Musk said. That said, the CEO also noted that “all of this is gonna pale in comparison to Optimus.”

17:10 CT – Musk reiterated that Optimus will be used at Tesla factories first, doing tedious tasks that no one wants to do.

Optimus production Version 2–maybe starting mid-next year–will be designed for 10,000 units a month vs 1,000 units a month. Version 3 is for 100,000 units per month, and with Version 2, Optimus robots may be delivered to other companies.

“Demand will not be a problem, even at a high price,” Musk said. He also noted that at one million units per year, Optimus’ production costs will be around or less than $20,000.

17:04 CT – Another investor question asked if Optimus is designed locked. Musk noted that Optimus is not design-locked at all. However, the CEO noted that “it is rapidly evolving in a good direction.” Musk also noted that other companies are missing real-world AI and manufacturing capabilities.

17:03 CT – The next investor question asked if other carmakers are interested in licensing FSD. Elon Musk confirmed that yes, they are. “What we’re seeing is at this point is significant interest in licensing FSD,” the CEO noted. But before FSD is licensed, Tesla has to reach unsupervised FSD first.

17:01 CT – Investor questions begin. The first is about unsupervised FSD’s release. Musk noted that he believes unsupervised FSD in California and Texas this year, with many more regions at the end of 2025.

“We’re looking for a safety level that is significantly safer than a human driver,” Musk said. “The only thing holding us back is an excess in caution,” Musk said.

17:00 CT – The CFO noted that Tesla’s growth came from Megapack and Powerwall. Both continue to be production-constrained, which will hopefully be relieved by China, whose Shanghai Megafactory is producing Megapacks. Tariffs, however, are very likely, Tesla’s CFO noted.

16:58 CT – Tesla’s CFO takes the stage. He credits the Tesla team for its performance in Q4. He also discussed some milestones, such as record deliveries in the Greater China market, which is extremely competitive.

Cost reduction continues as well, despite increased depreciation and other costs as the company prepared for the new Model Y. Overall cost per car now down below $35,000.

The new Model Y will be produced in all factories supporting the vehicle starting next month. This is unprecedented in Tesla history.

He notes that Tesla is also on track to release a more affordable model in the first half of 2025, and there will be more models from there.

16:54 CT – Elon Musk predicts increased demand in energy business. That said, he does admit that Tesla always has to allocate its battery supply. “2025 is really a pivotal year for Tesla. It might be viewed as the most important year in Tesla history,” Musk said.

16:50 CT – Elon, however, admitted that he’s making insane predictions. He cautions that his predictions aren’t necessarily precise. That said, the target is to make 10,000 Optimus robots this year. Elon is confident that Tesla can produce a few thousand this year, with a goal to ramp Optimus production every year.

Optimus’ capabilities are expected to be very impressive. Musk notes that Optimus would be able to play the piano or thread a needle. That’s how precise its hands would be. “Optimus will be able to play the piano and be able to thread a needle,” Musk said.

16:48 CT – Tesla expects to launch Unsupervised FSD as a service in Austin in June. Musk noted that Tesla’s unsupervised FSD system is already working very well in the company’s factories.

“The cars aren’t just driving to the same spot. The cars are programmed to a lane” or a destination parking spot for pick up from customers. Teslas will be in the wild–with no one in them–in Austin in June,” Musk said.

16:45 CT – Musk noted that Tesla’s current constraints are battery packs for now. “Things are going to ballistic next year…and ’27, and ’28,” he said.

Musk also stated that the training needs for the Optimus robot is 10x what’s needed for a car. A humanoid robot, however, probably has 1000 more uses than a car.

“We live at this unbelievable inflection point in history,” Musk said.

16:40 CT – “I know I’ve been called the boy who cried wolf. I’m telling you, there’s a damn wolf this time. It can drive you,” Musk joked, discussing FSD and his past failed predictions about when unsupervised FSD will be ready.

He also highlighted that while FSD behaved like a neophyte driver before, it won’t be like that forever.

“The only people who are skeptical are those who haven’t tried it (FSD),” he said. He also highlighted the potential of the Tesla Network. “It works fine in the US, and of course, it will work just well anywhere else. The reality of autonomy is upon us,” Musk added.

16:38 CT – Elon takes the stage. He states that Tesla ended the year with a run rate of 2 million cars per year. The Model Y was the world’s best-selling car again in 2024. He shares an optimistic outlook on Tesla’s autonomy program.

“Autonomy is 10X-ing,” Musk said, adding that he still sees a path toward Tesla becoming the world’s most valuable company by a mile. “There’s a path to that,” he said.

Musk noted that Tesla laid the groundwork for autonomous cars and robots in 2024, and these efforts will continue in 2025. “This will set up what I think will be an epic 2026 and a ridiculously good 2027 and 2028,” Musk said.

16:34 CT – Here we go! Tesla’s IR announces that Tesla CEO Elon Musk and a number of executives are present at the call.

16:30 CT – It’s time! It won’t be surprising if Tesla starts a bit late. That being said, there will probably be quite a number of interesting discussions in this call.

Just recently, Tesla posted the first video of its FSD Unsupervised system working in the Fremont Factory. That’s a very big deal.

16:25 CT – Hello, and happy earnings day to everyone! Tesla missed some of Wall Street’s expectations, but TSLA stock seems to be doing pretty well in today’s after-hours. It’s up about 2.3% as of writing.

As always, this might be a very interesting earnings call.

Don’t hesitate to contact us with news tips. Just send a message to simon@teslarati.com to give us a heads up.

Investor's Corner

Tesla negativity “priced into the stock at its current levels:” CFRA analyst

The CFRA analyst has given Tesla a price target of $360 per share.

In recent comments to the Schwab Network, CFRA analyst Garrett Nelson stated that a lot of the “negative sentiment towards Tesla (NASDAQ:TSLA) is priced into the stock at its current levels.”

The CFRA analyst has given Tesla a price target of $360 per share.

Q1 A Low Point in Sales

The CFRA analyst stated that Tesla’s auto sales likely bottomed last quarter, as noted in an Insider Monkey report. This was, Nelson noted, due to Q1 typically being the “weakest quarter for automakers.” He also highlighted that all four of Tesla’s vehicle factories across the globe were idled in the first quarter.

While Nelson highlighted the company’s changeover to the new Model Y as a factor in Q1, he also acknowledged the effects of CEO Elon Musk’s politics. The analyst noted that while Tesla lost customers due to Musk’s political opinions, the electric vehicle maker has also gained some new customers in the process.

CFRA’s Optimistic Stance

Nelson also highlighted that Tesla’s battery storage business has been growing steadily over the years, ending its second-best quarter in Q1 2025. The analyst noted that Tesla Energy has higher margins than the company’s electric vehicle business, and Tesla itself has a very strong balance sheet.

The CFRA analyst also predicted that Tesla could gain market share in the United States because it has less exposure to the Trump administration’s tariffs. Teslas are the most American-made vehicles in the country, so the Trump tariffs’ effects on the company will likely be less notable compared to other automakers that produce their cars abroad.

Investor's Corner

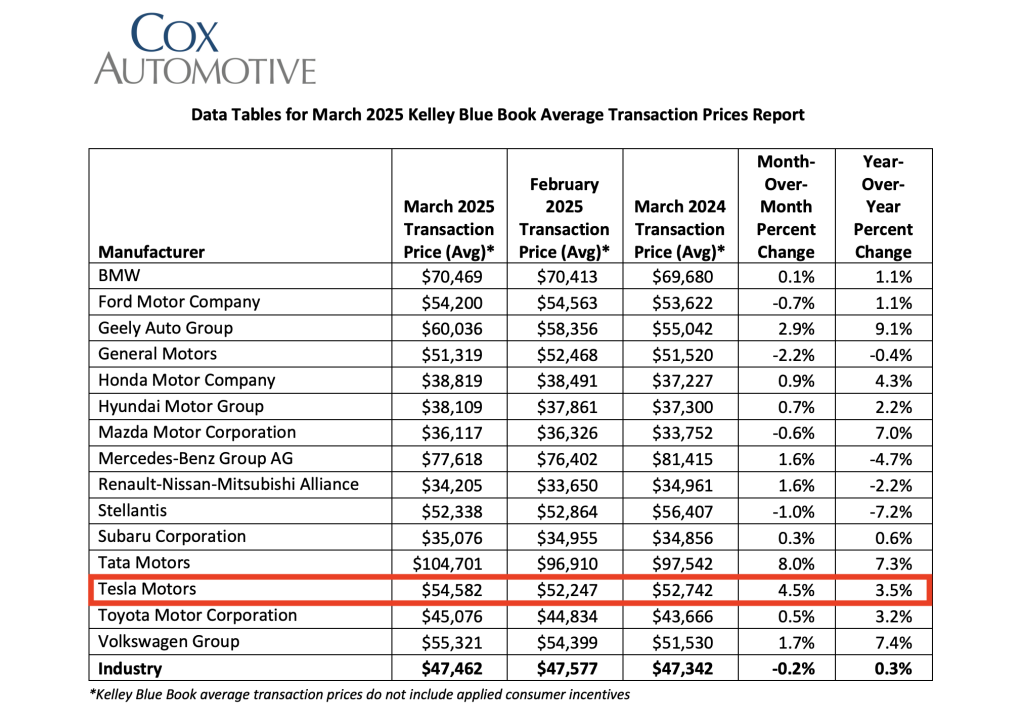

Tesla average transaction prices (ATP) rise in March 2025: Cox Automotive

Tesla Model Y and Model 3 saw an increase in their average transaction price (ATP) in March 2025.

Data recently released from Cox Automotive’s Kelley Blue Book has revealed that electric vehicles such as the Tesla Model Y and Model 3 saw an increase in their average transaction price (ATP) in March 2025.

Cox Automotive’s findings were shared in a press release.

March 2025 EV ATPs

As noted by Cox, new electric vehicle prices in March were estimated to be $59,205, a 7% increase year-over-year. In February, new EV prices had an ATP of $57,015. The average transaction price for electric vehicles was 24.7% higher than the overall auto industry ATP of $47,462.

As per Cox, “Compared to the overall industry ATP ($47,462), EV ATPs in March were higher by nearly 25% as the gap between new ICE and new EV grows wider. EV incentives continued to range far above the industry average. In March, the average incentive package for an EV was 13.3% of ATP, down from the revised 14.3% in February.”

Tesla ATPs in Focus

While Tesla saw challenges in the first quarter due to its factories’ changeover to the new Model Y, the company’s ATPs last month were estimated at $54,582, a year-over-year increase of 3.5% and a month-over-month increase of 4.5%. A potential factor in this could be the rollout of the Tesla Model Y Launch Series, a fully loaded, limited-edition variant of the revamped all-electric crossover that costs just under $60,000.

This increase, Cox noted, was evident in Tesla’s two best-selling vehicles, the Model 3 sedan and the Model Y crossover, the best-selling car globally in 2023 and 2024. “ATPs for Tesla’s two core models – Model 3 and Model Y – were higher month over month and year over year in March,” Cox wrote.

Cox’s Other Findings

Beyond electric vehicles, Cox also estimated that new vehicle ATPs held steady month-over-month and year-over-year in March at $47,462, down slightly from the revised-lower ATP of $47,577 in February. Sales incentives in March were flat compared to February at 7% of ATP, though they are 5% higher than 2024, when incentives were equal to 6.7% of ATP.

Estimates also suggest that new vehicle sales in March topped 1.59 million units, the best volume month in almost four years. This was likely due to consumers purchasing cars before the Trump administration’s tariffs took effect. As per Erin Keating, an executive analyst at Cox, all things are pointing to higher vehicle prices this summer.

“All signs point to higher prices this summer, as existing ‘pre-tariff’ inventory is sold down to be eventually replaced with ‘tariffed’ inventory. How high prices rise for consumers is still very much to be determined, as each automaker will handle the price puzzle differently. Should the White House posture hold, our team is expecting new vehicles directly impacted by the 25% tariff to see price increases in the range of 10-15%,” Keating stated.

Investor's Corner

Tesla bull sees company’s future clearly: Cathie Wood

ARK Invest’s Cathie Wood remains bullish as TSLA rebounds. Trump tariffs loom, but Wood says Tesla’s U.S. supply chain gives it an edge.

ARK Invest’s Cathie Wood explained her bullish stance on Tesla once again. Tesla shares dropped after a challenging first quarter. However, TSLA stock surged on Wednesday, proving Wood’s optimism was right on the money.

In an interview with Barron’s, Wood enumerated a few reasons ARK Invest sees a bright future for Tesla. She predicts that Tesla will launch a cheaper electric vehicle (EV), starting at around $30,000—half the price of a typical Model Y. “This will help bring affordability back into auto buying,” Wood said.

Tesla’s $30,000 EV model is expected to launch this quarter. However, Tesla is already refreshing its EV lineup and offering cheaper models. It debuted a Long Range All-Wheel-Drive Model Y “Juniper” in the U.S. on April 4, priced at $48,990 before a $7,500 tax credit.

Wood also touted Tesla’s upcoming robotaxi service, which she predicts will help consumers save upfront costs that would usually go to buying a new car. The ARK Invest CEO argues that Tesla’s robotaxi service would be cheaper than Uber and Lyft because it would save costs without a human driver.

Benchmark analyst Mickey Legg echoed Wood’s prediction in a recent note. Legg believes the negative narrative surrounding Tesla is exaggerated. The Benchmark analyst encouraged investors to look at the catalysts that could drive TSLA stocks up, like its AI developments.

Similar to Legg, Wood brushed off concerns about Elon Musk’s ties to Trump and negativity surrounding Tesla stock. “News cycles pass quickly nowadays, and the best cars are going to win.”

The ARK Invest CEO also shared her thoughts on Trump’s tariffs and how they would affect companies like Tesla.

“When businesses and consumers are scared, they’ll change the way they do things, and that’s usually good for the companies that are helping others do things better, cheaper, faster, more creatively, and more productively,” she said.

Wood noted that Tesla’s heavy North American sourcing will soften tariff blows. With affordability and tech in focus, Wood sees Tesla forging ahead despite Trump’s tariffs.

-

News1 week ago

News1 week agoTesla rolls out new, more affordable trim of the Model Y Juniper in U.S.

-

News2 weeks ago

News2 weeks agoTesla shares Optimus’ improved walk in new update video

-

Elon Musk1 week ago

Elon Musk1 week agoTesla Germany reports 4,935 units sold in Q1 2025

-

Investor's Corner2 weeks ago

Investor's Corner2 weeks agoTesla (TSLA) shares company-compiled Q1 2025 delivery consensus

-

News1 week ago

News1 week agoTesla expands Early Access Program (EAP) for early Full Self-Driving testing

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoNYC Comptroller moves to sue Tesla for securities violations

-

News1 week ago

News1 week agoTesla celebrates key milestone for 4680 battery cell production cost

-

News2 weeks ago

News2 weeks agoTesla’s Elon Musk reiterates ambitious Cybertruck water update