Tesla is set to provide its Megapack grid-scale batteries for a new energy storage project in Belgium, coming as the latest of many storage facilities popping up around the world.

Clean electricity provider Energy Solutions Group (ESG) will deploy Tesla Megapacks to establish a battery energy storage system (BESS) in Harmignies, Belgium, expected to cost around 85 million euros (~$87.4 million USD), according to a report from Netherlands-based publication De Tijd this week. The 75 MW/300MWh Tesla Megapack project will be housed in what was previously a cement factory in the village, and the companies expect it to be completed by the end of this year.

The funding for the project will come from a subordinated loan from government agency Wallonie Entreprendre, along with a bank credit from KBC, utilizing net operator Elia’s fees to generate revenue and manage the supply and demand of electricity.

The news of the project comes after Belgium energized its largest BESS project yet in Wallonia in October, featuring 40 Tesla Megapacks for a 50MW/100MWh capacity. That particular project is being operated by Corsica Sole, after being constructed and managed by Mitsubishi subsidiary Eneco.

READ MORE ON TESLA MEGAPACKS: Tesla highlights the Megapack site replacing Hawaii’s last coal plant

Tesla scales up Megapack production in the U.S. and now China

Tesla has been ramping up the production of its Megapacks for the past few years, after completing construction of a so-called “Megafactory” in Lathrop, California in 2022. While the company surpassed its 10,000th Megapack produced at the site in November, the factory is aiming to reach a volume production of 10,000 units (40GWh) annually, and production has been scaling up as more and more projects have been announced in markets around the world.

In addition to the Tesla Megafactory in Lathrop, California, the company recently completed construction on another Megapack production facility in Shanghai, China, which began trial production just a few weeks ago. The site is expected to begin deliveries within the first quarter of the year, along with eventually matching the 10,000-unit-per-year production goal held by the Lathrop Megafactory.

What are your thoughts? Let me know at zach@teslarati.com, find me on X at @zacharyvisconti, or send us tips at tips@teslarati.com.

Need accessories for your Tesla? Check out the Teslarati Marketplace:

News

Tesla’s vehicles led U.S. EV sales again last quarter: report

Tesla, Ford, and Chevrolet’s models led the pack in Q1, while more new EVs hit the road than ever.

Recent data has shown that Tesla’s Model Y and Model 3 remained the top-selling electric vehicle (EV) models in the U.S. in the first quarter, despite a decline in overall sales in the market.

As detailed in the latest Kelley Blue Book EV sales report, shared by Cox Automotive on Thursday, Tesla’s Model Y and Model 3 outsold the next several models combined during the first quarter, while the Cybertruck was the tenth best-selling EV overall.

Tesla sold 64,051 Model Y units, representing a 33.8 percent drop year over year, along with selling 52,520 Model 3 units, marking a 70.3 percent increase year over year, to outpace the next several models combined. The Tesla Cybertruck sold 6,406 units, while the Model S and X sold 1,280 and 3,843 units, respectively.

Tesla also launched a new version of the Model Y in the first quarter, likely explaining at least a part of the decline, though the brand also faces continued pressure from the public, as many have targeted stores and vehicles in protesting Elon Musk and the Trump administration.

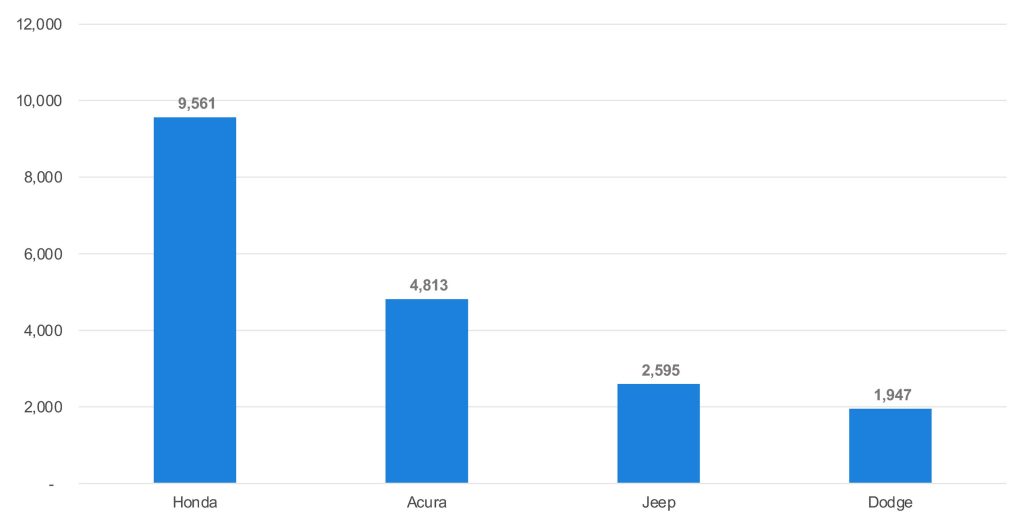

Meanwhile, the Ford Mustang Mach-E, the Chevy Equinox EV, and the Honda Prologue followed and made up the rest of the top five, with 11,607, 10,329, and 9,561 units sold, respectively. A number of models were also introduced to the market last year, such as the Porsche Macan, the VW ID.Buzz, and Volvo’s EX30 and EX90 models. Honda and Acura also added over 14,000 EVs to U.S. roads, marking an increase from having no products in Q1 2024.

Additionally, many models such as the Chevy Equinox EV, the Honda Prologue, and the VW ID.4 all climbed in the rankings from the full-year 2024 EV sales list, and it will be interesting to see how these and other emerging models hold as the year rolls on.

Cox also points out that Tesla’s overall sales were down 8.6 percent from last year’s first quarter, while General Motors (GM) sold over 30,000 EVs across its brands to lead the sector in sales growth.

See the full list of BEVs sold below, as ranked by volume. You can also check out the full Q1 EV sales data from Cox Automotive here, or read the firm’s press release on the report here.

READ MORE ON U.S. EV SALES: Tesla average transaction prices (ATP) rise in March 2025: Cox Automotive

EV models sold in the U.S. in Q1 2025, ranked by volume

- Tesla Model Y: 64,051

- Tesla Model 3: 52,520

- Ford Mustang Mach-E: 11,607

- Chevrolet Equinox EV: 10,329

- Honda Prologue: 9,561

- Hyundai Ioniq 5: 8,611

- VW ID.4: 7,663

- Ford F-150 Lightning: 7,187

- BMW i4: 7,125

- Tesla Cybertruck: 6,406

- Chevrolet Blazer EV: 6,187

- Toyota BZ4X: 5,610

- Rivian R1S: 5,357

- Cadillac Lyriq: 4,300

- Acura ZDX: 4,813

- Nissan Ariya: 4,148

- Tesla Model X: 3,843

- Ford E-Transit and Kia EV9 (tied): 3,756

- Kia EV6: 3,738

- BMW iX: 3,626

- GMC Hummer Truck/SUV: 3,479

- Porsche Macan: 3,339

- Hyundai Ioniq 6: 3,318

- Audi Q6 e-tron: 3,246

- Subaru Solterra: 3,131

- Chevrolet Silverado: 2,383

- Jeep Wagoneer EV: 2,595

- Nissan Leaf: 2,323

- Dodge Charger EV: 1,947

- Rivian R1T: 1,727

- Cadillac Escalade EV: 1,956

- VW ID.Buzz: 1,901

- BMW i5: 1,899

- Audi Q4 e-tron: 1,874

- Mercedes EQB: 1,622

- Cadillac Optiq: 1,716

- Rivian EDV500/700: 1,469

- Lexus RZ: 1,453

- Tesla Model S: 1,280

- GMC Sierra EV: 1,249

- Volvo EX30: 1,185

- Kia Niro: 1,162

- Porsche Taycan: 1,019

- Volvo EX90: 1,000

- Hyundai Kona EV: 914

- BMW i7: 888

- Mercedes EQE: 742

- Genesis GV60: 733

- Genesis GV70: 712

- Mini Countryman: 693

- Mercedes EQE: 742

- Audi Q8 e-tron: 535

- Mercedes G-Class and EQS (tied): 509

- Jaguar I-Pace: 381

- Volvo C40: 315

- Chevrolet Brightdrop 400/600: 274

- Audi e-tron: 250

- Volvo XC40: 218

- Mercedes E-Sprinter: 90

- Genesis G80: 51

- Chevrolet Bolt: 13

- Mini Cooper: 3

*Additional EV Models: 5,930

*The additional EV models category is likely made up of low-volume, luxury, and niche EV makers, such as those from Lucid and Polestar. However, at the time of writing, Cox Automotive has not yet responded to Teslarati’s request for comment on which vehicles were excluded.

Top 10 EV sellers by brand in the U.S. in Q1 2025

- Tesla: 128,100

- Ford: 22,500

- Chevrolet: 19,186

- BMW:13,538

- Hyundai: 12,843

- VW: 9,564

- Honda: 9,561

- Kia: 8,656

- Rivian: 8,553

- Cadillac: 7,972

News

These were the best-selling EV brands in the U.S. in Q1

Tesla remained the clear market leader in Q1, while Chevrolet and others saw substantial sales growth with the introduction of new models.

A recent report has revealed the latest estimates on electric vehicle (EV) sales for the first quarter of the year, with Tesla and Ford landing the top two spots, while GM’s brands saw the most sales growth.

On Thursday, Cox Automotive released data estimates for the U.S. EV market in Q1 2025, showing that Tesla remained the clear market leader among brands, while Ford, GM, BMW, and Hyundai made up the rest of the top five. The report estimated 296,227 EVs sold overall, marking an 11.4 percent increase year over year, and bringing new-vehicle EV sales to around 7.5 percent of the market.

Cox notes that this is still a steady increase from 7 percent of the market during Q1 last year, despite headwinds created by the Trump administration’s tariff war.

“The year certainly started strong, but the road ahead will be anything but smooth,” said Valdez Streaty, Cox Automotive analyst.

Tesla outsold the next top 10 brand names combined in Q1 with 128,100 units, though sales declined 8.6 percent year over year for the brand. Ford was the second-best-selling brand with 22,550 units sold, representing an 11.5 percent increase year over year.

Meanwhile, GM’s Chevrolet brand saw a 114.2 percent increase in sales from the first quarter of 2024 with 19,186, as led by the Chevy Equinox EV. The rest of the top 10 was made up, in order, by VW (9,564), Honda (9,561), Kia (8,656), Rivian (8,553), and Cadillac (7,972).

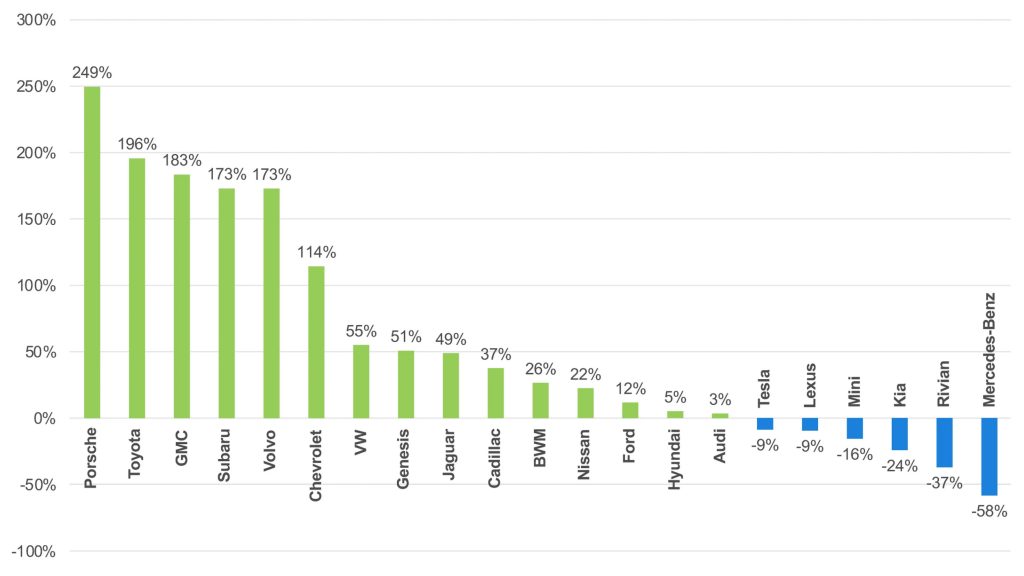

Brands such as Porsche, Toyota, and GMC joined the Chevy brand in seeing substantial sales growth, representing 249 percent, 196 percent, and 183 percent increases year over year, respectively.

It’s worth noting that multiple automakers own different brands, such as Chevrolet, GMC, and Cadillac being owned by GM, Audi being owned by VW, or Stellantis owning Jeep and Dodge, among other examples still.

EV Sales Volume Change by Brand: Q1 2025 versus Q1 2024

Credit: Cox Automotive

New Entries: EV Sales Volume in Q1 2025

Credit: Cox Automotive

READ MORE ON EV SALES: Tesla vs. competition: How many BEVs did OEMs sell in the U.S. in 2024?

Tesla doesn’t break out sales data by region, though the company recently reported delivering 336,681 units globally in the first quarter, representing a 13-percent drop from Q1 2024.

While it’s not a surprise that Tesla’s market share steadily declines as more competition enters the market, recent pressure on Elon Musk for his involvement with the Trump administration has, if nothing else, caused some automakers to try to poach Tesla owners with special trade-ins and other promotions.

Tesla has also been rolling out the refreshed Model Y, and the potential effects of the transition to it from the legacy model may play a role, though future quarters will show a better glimpse at the impact of the redesigned vehicle’s arrival.

At the time of writing, Cox Automotive has also not yet responded to Teslarati’s request for clarification on which brands are included in the “additional EV models” category. However, we expect these to include low-volume, luxury, and other niche EV brands, such as Lucid Motors. The publication also says the data overall excludes super exotics.

You can see EV sales ranked by brand below, check out the full data from Cox Automotive here, or read the publication’s press release on the report here.

Mass-market EV sellers in Q1 2025, ranked by brand

- Tesla: 128,100

- Ford: 22,500

- Chevrolet: 19,186

- BMW:13,538

- Hyundai: 12,843

- VW: 9,564

- Honda: 9,561

- Kia: 8,656

- Rivian: 8,553

- Cadillac: 7,972

- Nissan: 6,471

- Audi: 5,905

- Toyota: 5,610

- Acura: 4,813

- GMC: 4,728

- Porsche: 4,358

- Mercedes: 3,472

- Subaru: 3,131

- Volvo: 2,718

- Jeep: 2,595

- Dodge: 1,947

- Genesis: 1,496

- Lexus: 1,453

- Mini: 696

- Jaguar: 381

- Additional EV models*: 5,390

Total EV sales estimated by KBB in the U.S. in Q1 2025: 296,227

*The additional EV models category is likely made up of low-volume, luxury, and niche EV makers

Top 10 EV models sold in the U.S. in Q1 2025

- Tesla Model Y: 64,051

- Tesla Model 3: 52,520

- Ford Mustang Mach-E: 11,607

- Chevrolet Equinox EV: 10,329

- Honda Prologue: 9,561

- Hyundai Ioniq 5: 8,611

- VW ID.4: 7,663

- Ford F-150 Lightning: 7,187

- BMW i4: 7,125

- Tesla Cybertruck: 6,406

Here’s how many EVs were sold in the U.S. last year by model

Elon Musk

Former OpenAI employees show support for Musk lawsuit

The employees claim that the removal of non-profit status would “fundamentally violate” OpenAI’s mission.

After Elon Musk filed a lawsuit last year against the Sam Altman-run AI firm OpenAI, a group of former employees of the company this week has filed a legal brief supporting the xAI and Tesla leader’s case.

On Friday, a group of 12 former OpenAI employees said in a court filing that the company’s restructuring efforts would “fundamentally violate” the original non-profit mission, as detailed in a report from Reuters. The employees said they were in technical and leadership positions at the company, along with explaining that they believed the not-for-profit model was important for a variety of reasons.

During their time there, oversight of the non-profit was considered a key part of the company’s discussions, according to the group. Although this approach was regularly emphasized during their time at the company, recent pressures from investors to restructure the company into a for-profit could impede on crucial elements of the company’s mission.

The former employees argued that the non-profit structure helped in recruiting efforts, as many of the company’s staffers simply joined because they believed in the original mission. OpenAI, however, responded by claiming that the original mission wouldn’t change even if the structure does.

“Our Board has been very clear: our nonprofit isn’t going anywhere and our mission will remain the same,” the company said in a statement.

🚨NEWS: OpenAI CEO shares some of his thoughts on Elon Musk during a conversation with Bloomberg TV. As per Altman, OpenAI is not for sale.❌

Altman’s comments followed reports that Musk and several large investors have offered $97.4 billion to acquire the nonprofit controlling… pic.twitter.com/bDN8OBr2oR

— TESLARATI (@Teslarati) February 11, 2025

READ MORE ON ELON MUSK AND OPENAI: Elon Musk’s criticism about ChatGPT’s ‘woke’ nature gets response from OpenAI co-founder

Musk, who helped start OpenAI but left in 2018, has been highly critical of Altman and OpenAI’s efforts to become a for-profit in recent years. He officially filed a lawsuit against the ChatGPT maker last February, before dropping it in June and reviving it in August.

In the suit, Musk alleged that he had been “betrayed by Altman and his accomplices” after investing around $45 million dollars into the company, while OpenAI and investor Microsoft “established an opaque web of for-profit OpenAI affiliates, engaged in rampant self-dealing.”

In November, Musk’s legal team filed a motion for an injunction with U.S. District Judge Yvonne Gonzalez Rogers, who is presiding over the case, claiming that “irreparable harm” would occur if it wasn’t granted. The judge last month denied the injunction request, saying that Musk’s recent offer to buy OpenAI for $97.4 billion undermined his claims of harm.

“Musk has not demonstrated likelihood of success on the merits,” Rogers said in response to the request for an injunction, adding that the original $45 million “is just a lot of money [to invest] on a handshake.”

Despite denying the request, the judge did say that the case could proceed in a California courtroom as soon as this fall, “given the public interest at stake and potential for harm if a conversion contrary to law occurred.”

-

News1 week ago

News1 week agoTesla rolls out new, more affordable trim of the Model Y Juniper in U.S.

-

News2 weeks ago

News2 weeks agoTesla shares Optimus’ improved walk in new update video

-

Elon Musk1 week ago

Elon Musk1 week agoTesla Germany reports 4,935 units sold in Q1 2025

-

Investor's Corner2 weeks ago

Investor's Corner2 weeks agoTesla (TSLA) shares company-compiled Q1 2025 delivery consensus

-

News1 week ago

News1 week agoTesla expands Early Access Program (EAP) for early Full Self-Driving testing

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoNYC Comptroller moves to sue Tesla for securities violations

-

News1 week ago

News1 week agoTesla celebrates key milestone for 4680 battery cell production cost

-

News2 weeks ago

News2 weeks agoTesla’s Elon Musk reiterates ambitious Cybertruck water update